Global insurers trust Magnolia to deliver great experiences

What’s your insurance goal?

Solutions for insurance companies

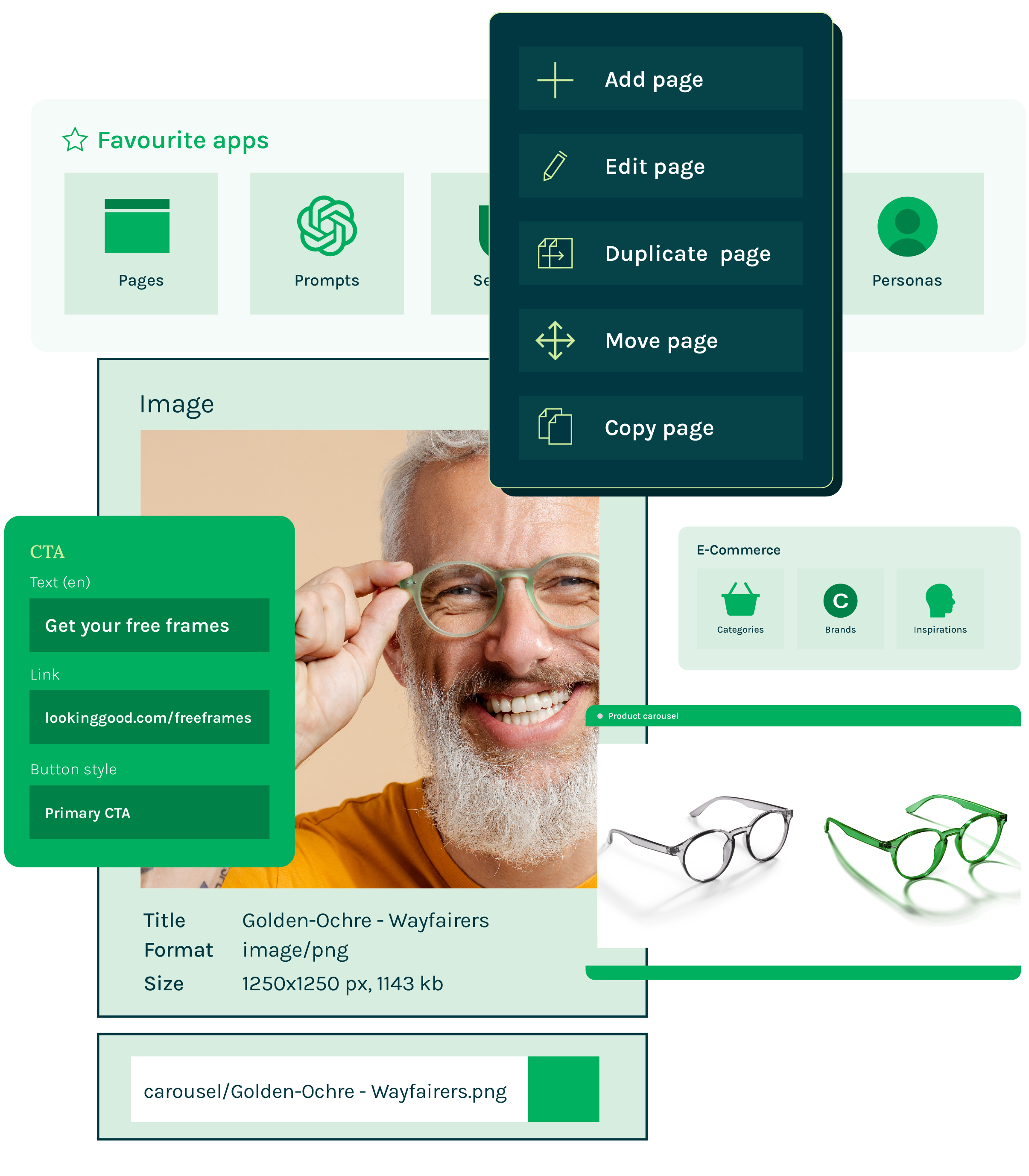

Powerful content

Magnolia provides compelling content at any touchpoint, from distribution to claims, ensuring you always engage positively with customers and meet their precise needs. All available via a single user interface.

More security

A great digital experience means nothing unless security is assured and you can comply with ever tighter industry regulations. Built on the strongest framework, Magnolia maintains key industry data security certifications and is continually updated.

Personalization

Track behavioral data at touchpoints and use analytics to understand customer motivations. Create highly focused and personalized content to engage at every step of the customer journey to build loyalty and lifetime customer value.

Speed, versatility, flexibility

Magnolia delivers content speedily and efficiently across multiple channels, such as web pages and apps. It automatically synchronizes content and creates a seamless digital experience thanks to multi-site and multi-language capabilities.

Enable self-service portals

Build self-service portals with personalized digital experiences for your customers that help them efficiently manage their accounts. Integrate your key business tools to ensure your portal users have access to the most up to date information.

Stronger partnerships

Magnolia empowers insurance organizations to create strong relationships with insurance brokers and enables the creation of agent portals. This enhances collaboration and communication, elevating customer service standards.

The power of DXPs for insurance

Read our white paper and learn about:

- How DXPs drives success in a rapidly changing market

- Strengthen critical touchpoints like quotes and claims

- Enhance customer lifetime value

- What to look for when choosing a DXP

- How Magnolia will help you stay ahead of competitors

Customers transforming their insurance business

See more case studies in insurancedifferent editorial teams managed in one central platform

page views a month supported on their intranet platform

content migration of over 20,000 pages in a short time