- Aug 4, 2023

- --

Insurers, there’s no substitute for digital experience

Experience Magnolia in action

Experience Magnolia's key features firsthand in an interactive product tour.

Take a tour now

A digital experience platform (DXP) can help established insurers consolidate their positions, protect and grow market share, and strengthen customer relationships.

Has disruption had its day? Is collaboration now the new industry trend? While insurtechs seem less threatening than a few years ago, and incumbents have formed many fruitful partnerships with erstwhile challengers, the threat of disintermediation remains. To defend their positions, insurers must seize the middle ground and use digital experience platforms to build on their natural strengths as established players.

Digital transformation and market forces

Like all industries today, insurance must embrace digital technology and adapt to changing consumer demands and new business models. Insurtechs and big tech have stolen market share from incumbents and are connecting more powerfully with consumers, and Covid-19 has accelerated digital transformation and underlined the gap between digital leaders and technology laggards.

Being data-driven and digitally enabled is now essential, and insurers who stand still and rely on legacy technology will fail to engage with customers and increasingly lose their relevance. Because of rapid digitalization and the growing power of customers, insurers must interact with prospects and policyholders across more channels and in more meaningful ways. In short, they must connect on a deeper level and add value to attract and retain customers.

When we talk about the importance of ‘digital experience’, it implies a new model of insurance where channel, context, content and messaging are focused precisely on customer needs. Every touchpoint and interaction must unify and enhance communication, and every digital journey must create a positive experience that will build relationships and promote lifetime customer value.

A DXP can do this and will help insurers reinforce their role and stay ahead of competitors and digital challengers. But before we look more closely at the ‘how’, and explore the key touchpoints, let’s define exactly what a digital experience platform is and explain its origins.

Definition and origins

DXPs have generated much interest in recent years, grabbing the attention of research firms such as Forrester and Gartner, whose reports have traced the development of the DXP marketplace and its leaders. Gartner defines a DXP as “an integrated and cohesive piece of technology designed to enable the composition, management, delivery and optimization of contextualized experiences across multi-experience journeys.”

It’s a slightly clunky description, but it covers the bases and underlines what DXPs do best: create meaningful and joined-up digital conversations with customers. Digital experience embraces the sum of online interactions, or conversations, that customers will have with insurers, and it spans websites, mobile apps, social media and other digital channels.

DXPs have evolved from content management systems (CMS) and web experience management (WEM) systems. A CMS enables you to manage text and images across digital channels, while WEM expands this capability with more personalized engagement and better integrations.

A DXP takes things a stage further and provides full integration and seamless digital experiences across all channels and entire customer journeys. And if the platform has a composable architecture, there are big gains in flexibility, customer focus, speed and agility.

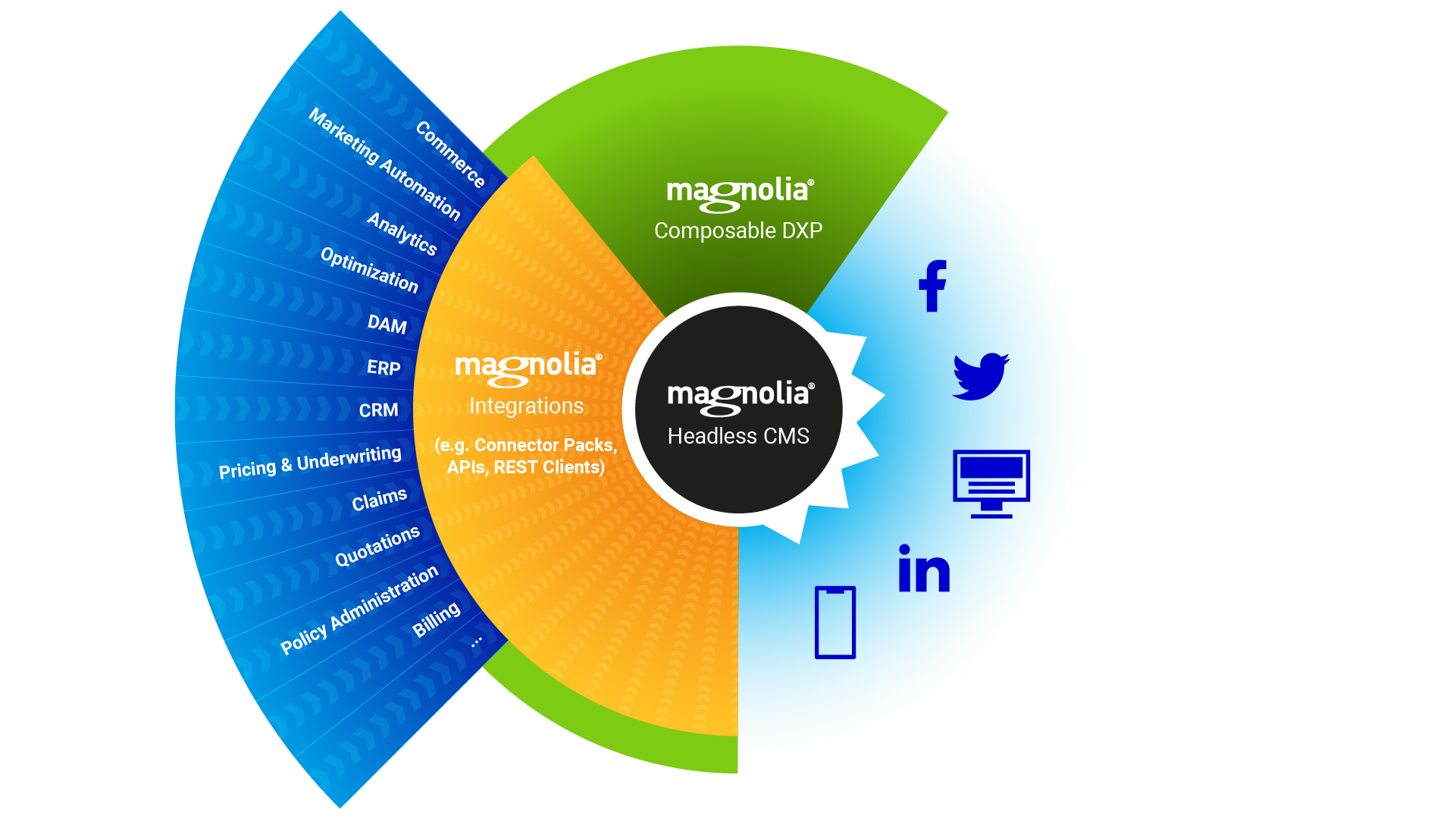

A composable DXP is the backbone for digital content. It can combine an entire marketing stack in one platform, including content management, marketing automation, CRM, pricing and underwriting, personalization, and analytics. DXP integrations (e.g. APIs, REST Clients, Connector Packs) are the building blocks to deliver great digital experiences quickly and efficiently.

As the diagram shows, Magnolia's DXP is a comprehensive solution that combines the power of Magnolia's headless CMS with an extensive range of integrations. With Magnolia's DXP, you can seamlessly connect both legacy systems and modern digital experience tools. It provides connector packs, which extend Magnolia into other core digital systems, allowing for easy integration and flexibility to connect with various tools.

For example, connector packs are available for analytics and commerce, providing ready-made connections to enhance data analysis and streamline ecommerce processes. Magnolia's DXP empowers businesses to leverage their existing technologies while integrating new capabilities to create exceptional digital experiences.

Additionally, Magnolia offers APIs and REST clients, enabling integration with any other tool of choice

Let’s look at some of the ways in which Magnolia’s DXP can revolutionize the insurance industry.

Use cases for insurers

Given the ability of a DXP to orchestrate customer journeys, there are clear benefits for businesses across all sectors and industries. For insurers who have yet to seize the benefits of digitalization and better customer experience, a DXP can have a big impact at key insurance touchpoints, from distribution and quotes to renewals and claims.

Customer journeys are typically segmented and disconnected, often with little communication between quotes and claims. This is a lost opportunity. Because a DXP focuses on conversations rather than transactions, insurers can maximize the value of existing touchpoints and develop new ones through relationship-building conversations and content.

Claims is a prime example. Communication needn’t be purely reactive, beginning only when a claim is filed. Insurers can mitigate risks by talking to their customers and influencing behavior and actions that might make a claim more likely. This is proactive insurance and not only can it reduce loss ratios, it can also strengthen the bond between an insurer and a policyholder.

By making the right connections and delivering rich content, a DXP means insurers can be more present and helpful in policyholders’ lives. This signals a shift away from simple indemnification – namely collecting premiums and underwriting risks – and the development of a value-added role that includes prevention and cross-selling/upselling, among other services.

Every insurance relationship starts with distribution and quotes. A DXP can improve marketing and increase conversions because, once again, it makes the right connections and delivers the right content. Insurers and their agents will have a complete view of every prospect and can disseminate personalized content through any channel. Tellingly, because the customer experience is enhanced, it becomes a positive buying experience rather than a negative selling one, inverting the adage that insurance is sold, not bought.

With a DXP, conversion is the first step in building lasting relationships. Insurers can develop deeper and more meaningful connections because they can curate and share content that is valued by their customers. That means increased customer satisfaction, less churn, stronger brand appeal.

Key touchpoints enhanced by a DXP

.2024-10-21-13-28-53.png)

Distribution

Before insurers reach the quote stage, they must find and attract potential customers. Equally, consumers must find insurers. Either way, it's a dynamic that depends on omnichannel delivery and targeted content across different media. A DXP brings buyers and sellers together, helping to launch the customer journey.

Magnolia's DXP streamlines the distribution process, ensuring that content is distributed to the appropriate audiences via the appropriate channels at the right time.

In the insurance industry, increasing visibility and attracting prospects is crucial. Effective SEO and web analytics play a vital role in achieving this goal. Businesses can improve their conversion rates by providing valuable content that guides visitors to find what they are looking for. However, if users have a poor digital experience (DX), they will likely leave and choose a different vendor.

The Magnolia Optimization Connector Pack's Siteimprove connector enables Magnolia customers to incorporate the Siteimprove platform into a seamless workflow to improve SEO, web analytics, and content quality. SEO, on the other hand, is pointless unless the content is relevant to purchasers, meaning Magnolia can make a significant impact on distribution here.

Magnolia also helps create personalized content for customers, providing an exceptional customer experience, thereby increasing conversion rates.

Before insurers reach the quote stage, they must find and attract potential customers. Equally, consumers must find insurers. Either way, it’s a dynamic that depends on omnichannel delivery and targeted content across different media. A DXP brings buyers and sellers together, helping to launch the customer journey.

Learn more about DXPs and distribution: a better way for insurers to connect with buyers.

Quotes

The drop-off rate will be high if the quote experience is long and off-putting, with complex and demanding forms. With a DXP, you boost conversion rates because onboarding focuses on meaningful and helpful conversations, not form-filling transactions, creating a positive customer experience.

Luckily, Magnolia simplifies this process for insurance firms by providing a tool that makes it easy to create easy-to-manage conversational forms directly in Magnolia or via an integration. This ensures insurers can connect in a more human and approachable way rather than routine transactions, increasing the likelihood of conversion. Magnolia’s API-based approach and composable architecture make our DXP highly flexible and easy to integrate with existing third-party tools to sell insurance policies online.

The Magnolia quotes experience makes for meaningful and customer-centric conversations by ensuring you positively engage with customers from the moment you start talking, increasing the likelihood of conversions.

Learn more about how to turn quotes into policies with a DXP.

Claims

This is an opportunity to develop deeper customer relationships based on preventative insurance. Normally, it's a touchpoint that only comes into play when a claim is filed, which is not a happy time for customers and means a loss for insurers if a claim is successful. However, by educating customers on risk prevention, insurers can reduce the number of claims submissions and build a stronger bond with customers. A DXP makes this possible because it facilitates content creation and delivery.

Using Magnolia’s best-in-class DXP, insurance companies can connect with their customers more effectively and offer them the support they need to prevent claims. Magnolia can enable insurers to provide their customers with personalized and relevant content on claims prevention and risk management. Insurers can use Magnolia to create informative blogs, interactive tools, and other digital resources that their policyholders can access anytime and anywhere, making it easier to take proactive steps to reduce the likelihood of a claim.

Magnolia does all this while having a great authoring experience.

This helps insurers to be present in their policyholders' lives more regularly, even during non-claim periods, creating opportunities for insurers to build stronger relationships and increase customer retention. By providing value-added services and resources, insurers can differentiate themselves from competitors and offer a more holistic customer experience.

Learn more about preventing claims in insurance.

Choosing a DXP provider

Insurers who make digital experience a strategic priority can:

Consolidate their position as incumbents

Differentiate themselves from competitors

Outmanoeuvre challengers and disruptors

Reduce loss ratios and boost premium income

Increase the lifetime value of customers

But it’s vital to choose the right digital experience platform and have a clear checklist of requirements. As a minimum, insurers need a platform that offers:

A seamless omnichannel service

The highest level of security

Personalized customer journeys

Optimized workflows

A 360-degree view of customers

Easy integrations

compatibility between legacy systems and new technology

Low code/no code development

A future-proof and adaptable architecture

Magnolia’s digital experience platform provides this and much more. It will help insurers find and keep customers in a fast-changing world of technology challengers and disruptors. With the growth of digital channels and business, customer interactions and experience have never been more important. That’s why established insurers must build and secure their future with digital experience platforms.

Magnolia for insurers

A DXP (digital experience platform) brings a wealth of benefits for insurers, and Magnolia is leading the pack.

Learn moreMagnolia in action

Magnolia is helping clients across all industries and sectors. See how we transformed digital experience for these leading finance and insurance brands:

Ping An

As one of the world’s largest insurers and financial services brands, Ping An needed a high-quality corporate website. The existing website was inconsistent, slow to update, and lacked cohesion.

Magnolia reduced content update time by 66% and achieved a threefold increase in website traffic.

"Magnolia allowed us to deliver seamless digital experiences in record time."

MCIS Insurance Berhad (MCIS Life)

This Malaysian life insurer needed a flexible DXP to support its new agency network.

Magnolia created a scalable and customizable platform that is easy to use and has headless capabilities and omnichannel delivery. MCIS Life can now optimize and simplify its web content, improve the digital experience and personalization of agents, and streamline information delivery.

"Magnolia transformed and automated the working processes between different departments and improved the marketing and IT culture and mindset.

"

Nationwide

Nationwide provides a broad range of financial and insurance products and needed a simple way to deliver engaging content and digital experiences to customers.

Magnolia delivered a full digital experience platform (DXP) in a very short time. Now Nationwide can quickly and easily create and publish compelling marketing campaigns and has achieved significant cost savings and improved authoring and content.

"We are very impressed by the speed of deployment. Without the fantastic support from the Magnolia team, we couldn’t have completed our implementation on time.

"